Why Should You Regularly Update Your Online Banking App?

This article aims to explore the significance of regularly updating online banking applications.

The following sections discuss the various benefits associated with such updates, including:

- Enhanced security measures

- Improved user experience

- Access to new features

- Bug fixes

- Compatibility with latest devices and operating systems

- Protection against cyber attacks

Adhering to an academic style, the present study presents an objective and impersonal analysis of the advantages that can be gained through the regular updating of online banking applications.

Key Takeaways

- Regular updates enhance security measures and protect customer data.

- Updates improve user experience by optimizing performance and introducing new features.

- Regular updates provide access to new features and functionalities for efficient financial management.

- Updates ensure compatibility with the latest devices and operating systems, enhancing functionality and usability.

Enhances Security Measures

Regularly updating an online banking app enhances security measures, thereby increasing customer satisfaction and reducing fraud risks.

Security is of utmost importance in online banking, as customers entrust their personal and financial information to these platforms. By regularly updating the app, developers can address any vulnerabilities or weaknesses that may exist in the system. This ensures that the app is equipped with the latest security features and patches, making it more resilient against potential threats and attacks.

Consequently, customers can have greater peace of mind knowing that their sensitive information is well-protected. Moreover, updating the app also helps in reducing fraud risks by implementing new security protocols and technologies that can detect and prevent fraudulent activities.

Overall, regular updates to online banking apps play a crucial role in enhancing security measures and safeguarding customer data.

Improves User Experience

Consistently updating the online banking application enhances the overall user experience by providing improved functionality and user interface design.

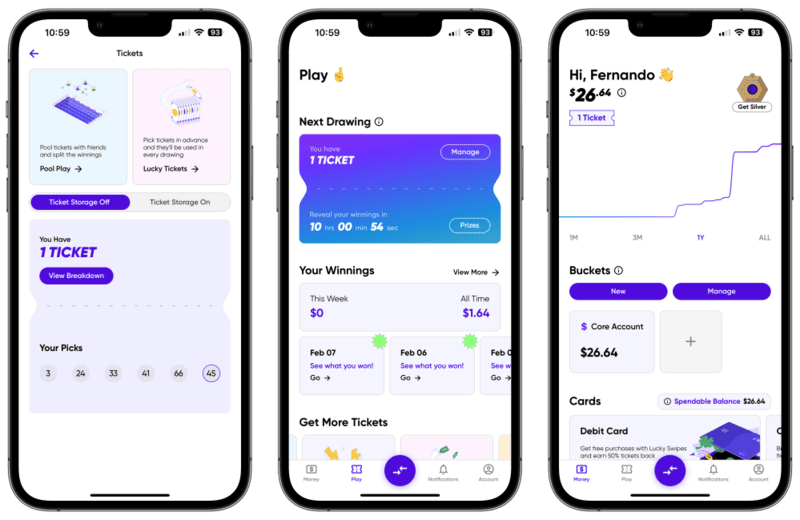

Regular updates improve speed and performance, increasing efficiency and convenience for users. By incorporating the latest technological advancements, updates can optimize the application’s performance, ensuring faster loading times and smoother navigation.

Updating the user interface design can also enhance the user experience by making it more intuitive and user-friendly. This allows users to easily access and navigate through different banking features and services.

Moreover, updates can introduce new features and functionalities that enhance convenience, such as the ability to make quick transfers or access real-time account information.

Overall, regularly updating the online banking application is crucial for providing users with an improved and seamless banking experience.

Provides Access to New Features

Integrating updates into the online banking application offers users access to new features and functionalities that enhance the range of services available to them. These updates can significantly increase convenience for users by providing them with additional tools and options to manage their finances more efficiently.

For example, updates may include features such as budgeting tools, expense tracking, or personalized notifications for account activity. By incorporating these new features, users can have a more comprehensive and streamlined experience in managing their financial affairs.

Furthermore, these updates also enhance financial management by allowing users to have a better understanding of their spending habits, savings goals, and overall financial health.

Overall, regularly updating the online banking app ensures that users can take advantage of the latest advancements in technology to improve their banking experience and financial management.

Fixes Bugs and Glitches

When it comes to updating online banking apps, two key points to consider are the improvement of user experience and the enhancement of security measures.

Updating the app can result in a smoother and more efficient user interface, allowing customers to navigate through the banking features with ease.

Additionally, regular updates often include security patches and measures that help protect against potential threats and vulnerabilities, ensuring the safety of users’ financial information.

Improves User Experience

Enhancing the user experience is an important goal for regularly updating online banking apps. By continuously improving the app’s features and functionality, it increases efficiency and boosts customer satisfaction. Regular updates ensure that the app remains compatible with the latest operating systems and devices, providing a seamless user experience. Additionally, these updates address any identified issues or vulnerabilities, enhancing the app’s security and protecting customer data. An updated app also allows for the incorporation of new technologies and innovative features, further enhancing the user experience. To illustrate the benefits of regularly updating online banking apps, the following table highlights the improvements that can be achieved through updates:

| Improvements | Benefits |

|---|---|

| Enhanced UI/UX | Intuitive and user-friendly interface |

| Faster load times | Quick access to banking services |

| Improved navigation | Easy and efficient task completion |

| Personalized features | Tailored experience for individual users |

Enhances Security Measures

Implementing comprehensive security measures is crucial for ensuring the protection of customer data and minimizing the risk of unauthorized access in online banking apps. To achieve this, online banking apps can enhance their security measures in the following ways:

-

Encryption: Encrypting customer data during transmission and storage adds an extra layer of protection, making it difficult for unauthorized individuals to intercept or decipher sensitive information.

-

Multi-factor authentication: Implementing multi-factor authentication requires users to provide multiple forms of identification, such as a password and a unique code sent to their mobile device. This adds an additional barrier to prevent unauthorized access.

Ensures Compatibility With Latest Devices and Operating Systems

Regularly updating online banking apps guarantees their compatibility with the latest devices and operating systems. This practice not only ensures that the app is accessible to a larger user base but also improves its performance and optimizes the user interface. By updating the app, developers can incorporate new technologies and features that enhance the app’s functionality and usability.

Additionally, updates often include bug fixes and security patches, which further enhance the app’s overall performance. Compatibility with the latest devices and operating systems is crucial as it allows users to take advantage of new hardware capabilities and software improvements.

Therefore, regular updates play a vital role in keeping online banking apps up-to-date and aligned with the evolving technological landscape.

Maintains Protection Against Cyber Attacks

Maintaining robust security measures is essential for protecting online banking apps against cyber attacks. These security measures include regularly updating the app to prevent data breaches and enhance privacy measures.

By regularly updating the online banking app, developers can address any vulnerabilities that may exist in the system, thereby reducing the risk of cyber attacks. Updates often include patches and fixes that address known security vulnerabilities, as well as implementation of new security features and protocols.

Additionally, updates ensure that the app remains compatible with the latest security standards and technologies. This helps to maintain the integrity of the app and protect sensitive user information from unauthorized access.

Therefore, regular updates play a crucial role in preventing data breaches and enhancing privacy measures in online banking apps.

Frequently Asked Questions

How Often Should I Update My Online Banking App?

Regularly updating your online banking app is essential to ensure the security and functionality of the application. This can be done by checking for app updates regularly, which helps to avoid potential vulnerabilities and enjoy the benefits of using a secure online banking app.

What Are the Potential Risks of Not Updating My Online Banking App Regularly?

Potential consequences of not regularly updating your online banking app include increased vulnerability to cyber attacks, unauthorized access to personal and financial information, and potential financial losses. Thus, emphasizing the importance of software updates in maintaining security.

Will Updating My Online Banking App Affect My Saved Preferences and Settings?

Updating your online banking app regularly can have implications for your saved preferences and settings. It is important to weigh the pros and cons, particularly in terms of security, as updates often address vulnerabilities and enhance protection.

Can I Still Access My Online Banking Account if I Don’t Update the App?

Accessing your online banking account without updating the app may be possible through alternative ways, such as using a web browser. However, it is recommended to regularly update the app to ensure security, access to new features, and optimal performance.

How Can I Ensure That I Am Downloading the Official and Legitimate Updates for My Online Banking App?

To identify fake app updates for an online banking app, users should verify the source of the update, check for official app store downloads, and read reviews. If a fake update is accidentally downloaded, users should uninstall it immediately and run a security scan.